Inside Paradeplatz, December 26, 2025

UBS is Caught in the Middle of the Epstein Scandal

Ghislaine Maxwell, accomplice of the girl sex offender, at the bank from 2014, with USD 19 million in 2016: Multiple structures, sensitive transactions until 2019. Read the full article

(Adjust your browser for the English version)

swissinfo.ch, September 23, 2025

France: UBS pays €835 million to settle tax dispute

UBS has settled an old tax dispute in France and will pay a total of 835 million euros (CHF780.7 million) to put an end to this case dating from 2004 to 2012, it announced on Tuesday. Read the full article

Bloomberg Tax, March 21, 2025

Ex-UBS CEO to Pay $4.9 Million for Not Reporting Swiss Accounts

Former UBS North America CEO Markus Rohrbasser agreed on Friday to pay more than $4.9 million to the IRS for failure to report his interest in foreign bank accounts over an 11-year span. Read the full article

swissinfo.ch, March 19, 2025

UBS Client Says His Wife Moved In With Their Wealth Adviser. It Got Messy

When Richard Kallman’s 26-year marriage failed, he arrived at a meeting to hash out the separation, expecting to see his wife and her lawyer. But instead, the couple’s new wealth manager from UBS Group AG showed up and demanded Kallman fork over $9 million. Read the full article

swissinfo.ch, March 10, 2025

UBS fined in France for harassing whistleblowers

UBS Europe, which absorbed the French branch, was also ordered to pay €50,000 in damages to Nicolas Forissier, the former head of internal auditing. Read the full article

finews.asia, February 20, 2025

UBS and Legal Challenges: A Cloud of Uncertainty

UBS is embroiled in multiple high-stakes legal battles worldwide, primarily linked to its Wealth Management division and the takeover of Credit Suisse. These cases, spanning from historical tax evasion allegations to client disputes, significantly impact the bank’s financial exposure. Read the full article

The Wall Street Journal, January 4, 2025

Nazi Ties to Credit Suisse Ran Deeper Than Was Known, Hidden Files Reveal

Switzerland thought it came to terms with its Nazi-assisting past after harrowing probes in the 1990s led its two largest banks to pay more than $1 billion restitution to Holocaust victims. Documents unearthed in bank archives show it might have been at least in part a whitewash. Read the full article

The Daily Signal, December 19, 2024

IRS Whistleblowers Push Forward on Defamation Case Against Hunter Biden’s Lawyer

The drama and legal saga adjacent to Hunter Biden’s conduct isn’t over yet. Read the full article

SWI swissinfo.ch, December 4, 2024

UBS Stunned by Mafia Analogy at Whistleblower Pressure Trial

A representative of UBS Group AG said he was “stunned” that witnesses referred to the bank as a mafia-like organization as the French branch stands accused in Paris of harassing its former whistleblowing staffer. Read the full article

Paris Match, November 29, 2024

UBS : Ils ont stoppé la grande évasion

Malgré son gabarit de colosse, rien ne prédisposait Bradley Birkenfeld à faire sauter la banque. Avec le Français Nicolas Forissier, comme lui ancien cadre d’UBS, l’Américain a pourtant tenu un rôle crucial dans la révélation de la plus grande fraude fiscale de l’Histoire – avec, à la clé, un joli magot. Read the full article

finews.com, October 14, 2024

UBS Faces Trouble Over Business with U.S. Pension Funds

According to media reports, a group of tax activists is seeking to block UBS from continuing its business with U.S. pension funds. The bank is currently trying to extend an existing exemption but legacy issues from Credit Suisse could further complicate the situation. Read the full article

Inside Paradeplatz, August 10, 2024

Scam in the Carribean

Documents from a Bahamas lawsuit show that UBS refused to send clients SEC-required confirmations of trades made into the U.S. market. The clients believe the trades were not executed, that UBS created internal trading records and stole their money. Read the full article

CNBC, March 26, 2024

Ex-UBS broker sentenced in fraudulent Puerto Rico bond sales scheme

A former top broker in Puerto Rico for the Swiss banking giant UBS was sentenced to a year and a day in prison Tuesday, months after he pleaded guilty to criminal bank fraud for pocketing $1 million in commissions in a scheme that saw many investors lose their life savings. Read the full article

Reuters, February 8, 2024

US Supreme Court in UBS case makes it easier for whistleblowers to win suits

The U.S. Supreme Court on Thursday made it easier for whistleblowers to win lawsuits accusing companies of unlawfully firing them as retaliation for disclosing wrongdoing, rejecting a bid by Switzerland’s UBS Group (UBSG.S), opens new tab to impose a higher bar. Read the full article

CovertAction Magazine, November 22, 2023

Corruption of U.S. Justice Department and the Two-Tiered Justice System: The Case of Whistleblower Bradley Birkenfeld

Bradley Birkenfeld is a former Swiss banker who helped the Internal Revenue Service (IRS) recoup billions of dollars in tax revenues after exposing the largest tax fraud in U.S. history. Read the full article

Financial Times, November 15, 2023

UBS fails to overturn guilty verdict in French tax evasion case, Read the article (paywall)

The Guardian, Nov 7, 2023

UBS reports $785m loss due to costs of Credit Suisse integration

UBS has reported a $785m (£637m) quarterly loss, its first in nearly six years, as the Swiss banking group counted the costs of rescuing its rival Credit Suisse earlier this year. Read the full article

CNBC, August 14, 2023

UBS to pay $1.4 billion over fraud in residential mortgage-backed securities

Swiss bank UBS agreed to pay a combined $1.4 billion in civil penalties over fraud and misconduct in its offering of residential mortgage-backed securities dating back to the global financial crisis, federal prosecutors announced Monday. Read the full article

The Associated Press, July 24, 2023

UBS fined nearly $400 million related to Credit Suisse’s relationship with failed fund Archegos

Swiss banking giant UBS will pay nearly $400 million in fines to U.S., Swiss and U.K. banking authorities for the management failures of Credit Suisse, which UBS bought in June, related to how Credit Suisse handled its relationship with collapsed hedge fund Archegos Capital Management. Read the full article

The San Juan Daily Star, July 18, 2023

UBS seeks removal of tax evasion allegations to federal court

Asian investors have joined a series of landmark international lawsuits being filed against the Swiss government over its handling of the takeover of troubled bank Credit Suisse. Read the full article

BBC, May 4, 2023

Credit Suisse: Asia investors sue Switzerland over bank collapse

Asian investors have joined a series of landmark international lawsuits being filed against the Swiss government over its handling of the takeover of troubled bank Credit Suisse. Read the full article

Bloomberg, May 3, 2023

UBS Inherits Legacy of Legal Headaches From Credit Suisse

When UBS Group AG integrates Credit Suisse Group AG in the coming months, the Swiss bank plans to run staff from the scandal-prone former rival through what Chairman Colm Kelleher dubbed a “culture filter” to weed out potential bad apples. Read the full article

Reuters, May 1, 2023

U.S. Supreme Court to examine whistleblower claims against financial firms in UBS case

The U.S. Supreme Court on Monday agreed to examine how difficult it should be for financial whistleblowers to win retaliation lawsuits against their employers as the justices took up a long-running case involving Switzerland’s UBS Group AG. Read the full article

Switzerland Times, January 30, 2023

Oligarch Abramovich stashed 700 million at UBS

Roman Abramovich’s money was still welcome at UBS until the outbreak of war. Fedpol came to a different verdict in 2018: it spoke out against a residence permit for the oligarch in Switzerland. Read the full article

Reuters, November 21, 2022

U.S. Supreme Court rebuffs RBS ex-banker’s whistleblower award bid

The Supreme Court on Monday declined to hear former Royal Bank of Scotland managing director Victor Hong’s bid to collect a U.S. government whistleblower award of at least $490 million for reporting alleged misconduct related to the institution’s sales of mortgage-backed securities. Read the full article

SWI swissinfo.ch, November 8, 2022

UBS raided in money-laundering probe of Russian

On Tuesday Frankfurt prosecutor Georg Ungefuk did not identify the suspect by name, but said the raids were connected to an investigation in which officials raided a luxury yacht and two dozen properties in Germany in September. Read the full article

U.S. Securities and Exchange Commission, June 29, 2022

UBS to Pay $25 Million to Settle SEC Fraud Charges Involving Complex Options Trading Strategy

The Securities and Exchange Commission today announced that UBS Financial Services Inc. has agreed to pay approximately $25 million to settle fraud charges relating to a complex investment strategy referred to as YES, or Yield Enhancement Strategy. Read the full article

SWI swissinfo.ch, June 28, 2022

Ex-UBS Staffer Wants Payday for Exposing Swiss Billions

An ex-UBS Group AG employee turned whistle-blower may be getting closer to forcing reluctant French authorities to compensate her for helping them uncover about 9.6 billion euros ($10.2 billion) that taxpayers stashed away in Swiss bank accounts. Read the full article

HEC Paris, May 20, 2022

Whistleblower Urges Academics to Support European Anti-fraud Network

Bradley Birkenfeld’s visit to HEC Paris’ campus could not have been timelier. As the war in Ukraine raged, western governments sought to impose unprecedented economic sanctions on Russia and confiscate the fortunes of some of its richest citizens – often hidden in the West’s financial institutions. “The role of whistleblowers as central players in the enforcement of [sanctions] is taking on fresh urgency,” stated Politico. Read the full article

The Guardian, May 2, 2022

Swiss consider amending banking secrecy laws amid UN pressure

Swiss politicians will debate the future of the country’s controversial banking secrecy law this week, as it faces pressure from UN officials to scrap rules under which whistleblowers and journalists who report on potential wrongdoing can be prosecuted. Read the full article

Law360, March 15, 2022

Ukraine War Fuels Push To Expand Tax Whistleblower Program

Several senior Democrats said there were good prospects for advancing a bipartisan plan to expand the tax whistleblower program as lawmakers hunt for ways to ramp up pressure on Russia and President Vladimir Putin to end the war in Ukraine. Read the full article

Politico, March 7, 2022

Campaigners demand protection for UK whistleblowers to give Russian sanctions bite

As sanctions ratchet up pressure on Moscow, the role of whistleblowers as central players in their enforcement is taking on fresh urgency. Read the full article

Financial Times, February 21, 2022

Swiss banks’ struggles to move on from murky past hit by documents leak

Switzerland’s attempts at shedding its long-held reputation as the global banking centre of choice for oligarchs, corrupt government officials and drug smugglers has been dealt a blow by the leak of documents detailing the accounts of 30,000 Credit Suisse clients. Read the full article

The Guardian, February 21, 2022

Crooks, kleptocrats and crises: a timeline of Credit Suisse scandals

The revelations that Credit Suisse has been used by crooks, money launderers and corrupt politicians are a public relations crisis for the banking giant. Read the full article

OpenSecrets, October 8, 2021

Pandora Papers reveal offshore finances of the global elite currying influence in U.S.

A trove of 11.9 million records released last week exposed the offshore financial secrets of hundreds of politicians, billionaires, celebrities, royal family members and other wealthy individuals in more than 200 countries and territories across the globe. Read the full article

Inside Paradeplatz, July 8, 2021

UBS closes Beirut office: because of Big Scandal?

Switzerland and France are investigating a major embezzlement case involving money laundering against Lebanon’s central bank chief and his brother. The Federal Prosecutor’s Office has opened proceedings and is demanding legal assistance. Read the full article

Reuters, June 28, 2021

French court rejects constitutional challenge by UBS in tax case

A French court on Monday rejected a challenge filed by Swiss bank UBS (UBSG.S) linked to constitutional aspects of its French tax case, confirming that judges would rule on the lender’s appeal against a 4.5 billion euro ($5.36 billion) fine on Sept. 27. Read the full article

ProPublica, June 8, 2021

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

In 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes. Read the full article

JDSUPRA, June 4, 2021

Will Europe Fail to Protect Whistleblowers?

Pursuant to a Directive enacted by the European Parliament and Council, all 27 nations within the European Union (EU) must “bring into force” whistleblower protection “laws, regulations and administrative provisions” by December 17, 2021. These whistleblower laws must meet the minimum requirements of the Directive. Each nation may also enact laws that are “more favourable to the rights of reporting persons,” i.e., the whistleblowers. Progress within each nation-state has been slow, but there are some troubling signs. Read the full article

Forbes, May 30, 2021

Taking The Department Of Justice Out Of Qui Tam Cases Might Improve Enforcement Actions

The most efficient and least emotional way to cover government budget deficits may not be to collect more in taxes, but instead collect more in damages from massive government contractor fraud. Could it be that conflicts in The Department of Justice (DOJ) and nationwide local prosecutors in U.S. Attorney’s Offices (AUSAs) have been far too lenient over the years despite the False Claims Act (FCA)? There is more money to be had and, in the process, could serve as a deterrent for fraud and waste. Read the full article

Bloomberg, May 20, 2021

UBS, Nomura Hit Hardest as EU Fines Crisis-Era Bond Cartel

UBS Group AG and Nomura Holdings Inc. and UniCredit SpA were fined a total of 371 million euros ($452 million) by the European Union for colluding on euro government bond trading during the region’s sovereign debt crisis. Read the full article

BBC News, May 18, 2021

Jonathan Taylor: Oil whistleblower’s Monaco extradition bid upheld

An oil industry whistleblower, stuck in Croatia since his arrest 10 months ago, is to be extradited to Monaco over allegations of bribery and corruption. Read the full article

The Telegraph, May 14, 2021

Finance chief who exposed currency scandal fights Swiss extradition bid for criminal defamation

Financial chief believes an extradition request for criminal defamation is linked to his role in exposing a multi-billion currency scandal. Read the full article

Reuters, May 14, 2021

Swiss Life to pay $77.4 million to settle U.S. criminal tax evasion case

Swiss Life Holding AG agreed to pay $77.4 million and enter a deferred prosecution agreement to resolve a U.S. criminal case in which Switzerland’s largest insurer was accused of helping wealthy American clients evade taxes. Read the full article

Business Review, April 23, 2021

Achieving full-cycle anonymity for whistleblowers by paying the reward in crypto

Romania leads most European Union (EU) nations in the adoption of the EU Whistleblower Directive with strong support of Minister of Justice, Stelian Ion, and Member of Parliament, Sebastian Burduja, who attracted the assistance of numerous whistleblower experts from both the United States and Europe. This week, they continued to demonstrate their undeterred interest for a smooth implementation of the directive to include anonymity, protection and rewards by participating at the 18th edition of the Tax, Law, and Lobby: Whistleblower Focus Conference. Read the full article

National Whistleblower Center, April 8, 2021

Romania to Become a Model Country for Adopting the EU Whistleblowing Directive Backed by Whistleblower Experts

Romania is leading the way among European Union (EU) nations in the adoption of the EU Whistleblowing Directive, given the good working relationship between Romania’s Minister of Justice, Stelian Ion, and Member Parliament of Romania, Sebastian Burduja, who initiated the effort alongside numerous whistleblower experts from both the United States and Europe. Read the full article

Blick, April 7, 2021

“When does the Swiss taxpayer have enough?”

Bradley Birkenfeld (56) started the tax dispute between Switzerland and the USA. The then UBS banker in Geneva was an ambivalent key figure in the dispute between the US judiciary and the big bank: the US Department of Justice needed his information to show how UBS helped American customers hide money from the tax authorities. Read the full article

NZZ, April 7, 2021

Whistleblower Bradley Birkenfeld attacks UBS

The ex-UBS banker and whistleblower Bradley Birkenfeld attacks his former employer in a full-page advertisement in the “Tamedia” newspapers, one day before the UBS general meeting. He wrote a letter to UBS shareholders, clients and employees as well as to Swiss taxpayers. Read the full article

Geneva Lunch, April 4, 2021

How Anonymous Bank Accounts Changed The Banking Laws

The ultra-rich, powerful, and the echelons of this world, for years, have used anonymous bank accounts for all sorts of transactions. Whether it be for availing complete privacy or to evade taxes, anonymous bank accounts are completely legal. You may be thinking that these sorts of accounts are used by the corrupt, however, some people wish to maintain the privacy or to tackle some legal issues eliminating the notion that these accounts are used for illegal activities. Read the full article

The Atlantic, February 10, 2021

A Million-Dollar Pardon Offer at the Trump Hotel

Soon after the November election, a business colleague of Donald Trump’s close ally Corey Lewandowski offered a whistleblower and convicted ex-banker an expensive deal: In exchange for a $300,000 fee up front—plus another $1 million if successful—the two men would push the then-president for a pardon, according to the ex-banker and an associate who heard the pitch. Read the full article

Communities Digital News, December 30, 2020

Biden will bring a red eclipse of China and crime back to the White House

Joe Biden and his family made a bed with China that puts at risk all we know as American and freedom. They are partners in crime and cover-ups, in tandem quests for money, influence, and power. The American people must wake up and see the red eclipse threatening to snuff out life as we knew it before a China virus, before a stolen election. Read the full article

Townhall, December 10, 2020

When Whistleblowers Are Treated Like Criminals

As a writer, I get a lot of pitches and stories sent to me. Somehow or another, writers end up on email lists for any number of candidates, fundraisers, causes, activist groups, etc. All those press releases and pitches can clutter up your inbox pretty quickly. Read the full article

Gateway Pundit, December 8, 2020

WAYNE ROOT: Mr. President, Here are Two Great American Heroes to Pardon

Mr. President, presidential pardons are reserved for great Americans who made a mistake and have paid their dues to society. Here are two great patriots who fit the bill perfectly. Read the full article

Communities Digital News, December 7, 2020

Crimes of political elites: How Biden, Democrats smash Americans’ trust

Russian-American writer and philosopher Ayn Rand (Atlas Shrugged, The Fountainhead) says “The only power any government has is to crack down on criminals.” However, it seems the government has chosen to ignore Election 2020 and what surely looks to be crime, fraud, and graft. Read the full article

New York Post, November 11, 2020

Swiss to ban deducting bribes from taxes starting in 2022

Swiss companies will no longer be able to deduct bribes paid to private individuals from their taxes, Switzerland’s government said Wednesday, according to an update of tax laws due to take effect on Jan. 1, 2022. Read the full article

The Epoch Times, November 2, 2020

Obama Administration Covered Up Tax Evasion Scandal

Bradley Birkenfeld, a former manager at Switzerland’s second-largest bank and one of the biggest whistleblowers in U.S. history, said he believes there was a special interest coverup by key officials within the Obama administration. Read the full article

The Washington Examiner, October 30, 2020

Another Hunter Biden laptop taken into custody during DEA raid: Report

Another laptop tied to Hunter Biden was reportedly obtained by the Drug Enforcement Administration earlier this year. Read the full article

Thought to Action, October 22, 2020

Exposing A Culture of Corruption with UBS Tax Fraud Whistleblower Brad Birkenfeld

Forbes, October 21, 2020

The Controversial History Of Whistleblowers And Those Who Are Speaking Out

Continental Naval officers gathered below the deck of the USS Warren on February 19, 1777 to sign a petition to the Continental Congress documenting abuses by their commander. Without any legal protections for speaking out, those men understood that they could be branded as traitors for denouncing the highest-ranking American naval officer in the midst of war. Read the full article

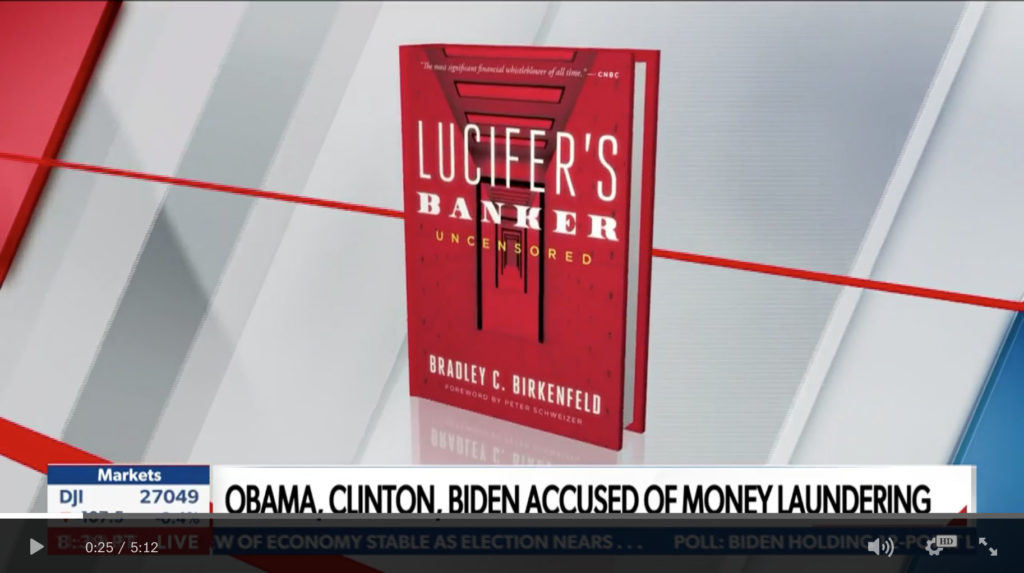

“The Hard Question” with Blanquita Cullum, October 16, 2020

The Hard Question with Blanquita Cullum on the SmartTalk Radio Network: Bradley Birkenfeld author of “Lucifer’s Banker-Uncensored.” He has been called,”The most significant financial whistleblower of all time” (CNBC). Senator Chuck Grassley has said, “I am writing to express my concern about continued tax evasion by taxpayers using secret Swiss band accounts, particularly accounts at UBS AG (Union Bank of Switzerland).”

In addition to Birkenfeld’s original gripping story of secret offshore banking, providing readers the rare glimpse into the illicit world of the wealthy and powerful, and their acts of greed and malfeasance, NEW egregious revelations and evidence are presented which directly involve:• Barack Obama , Joe Biden, Hunter Biden, Hillary Clinton, Kevin Costner, Bill Clinton, Eric Holder ,John Kerry. Birkenfeld met with Julian Assange—what happened in the meeting- what did he find out? His bombshell revelation helped the U.S. Treasury recover over $25 billion from Swiss banks and U.S. tax cheats—yet he was arrested and served 30 months in prison. Later he received from the IRS a whistle-blower award of $104 million. A compelling interview.

The Wayne Allyn Root Show, October 16, 2020

The BL, October 14, 2020

Clinton foundation charged with evading up to $2.5 billion in taxes

A U.S. federal judge ruled that a tax evasion complaint against the Clinton Foundation should go forward. Bill and Hillary Clinton’s organization is accused of evading up to $2.5 billion in taxes, according to a report by Just The News. Read the full article

“Digging Deeper” on Patriots Soapbox, October 9, 2020

The Essential BRADLEY BIRKENFELD Interview – BANK CORRUPTION WHISTLEBLOWER – GREAT AWAKENING. Watch the interview

The Wayne Allyn Root Show, October 9, 2020

Whistleblower News Network, October 6, 2020

New Poll: Americans Want Strong Protections for Whistleblowers Who Report Government or Corporate Fraud

Americans strongly believe (86%) that whistleblowers who report corporate or government fraud deserve protection from harm, according to an exclusive new poll commissioned by the Whistleblower News Network. In addition, 82% of Americans say that passing stronger laws that protect employees who report corporate fraud should be a priority for Congress. Read the full article

Alain Guillot Podcast, September 29, 2020

167 Banker Gets $104 Million For Exposing Tax-Cheats; Bradley Birkenfeld

Bradley Birkenfeld is the most significant financial whistleblower in history and the author of Lucifer’s Banker UNCENSORED: The Untold Story of How I Destroyed Swiss Bank Secrecy, (September 2020). As an international private banker, he exposed how UBS, the world’s largest bank, helped ultra-wealthy Americans commit billions in tax fraud. Read the full article and listen to the podcast

Whistleblower News Network, September 28, 2020

Bradley Charles Birkenfeld: Whistleblower and Gladiator in the Financial Arena

Bradley Birkenfeld was born in February of 1965 in a household where his mother was a nurse/housewife, and his father was a neurosurgeon. He had two older brothers and remembers a childhood full of sports and friends in Brookline, Massachusetts. Both of Birkenfeld’s parents were in the “giving industry.” It used to be a prestigious job to help people back in the ’60s and ’70s in the medical profession, and Birkenfeld stated that seeing what his parents did to help others “resonated” with him. Read the full article

Corporate Crime Reporter, September 23, 2020

SEC Rejects Major Whistleblower Rule Changes

The Securities and Exchange Commission (SEC) today rejected major changes to its whistleblower program in a 3-2 vote. “Whistleblowers scored a major victory today when the SEC backed down from two proposals that would have devastated its whistleblower reward program,” said Stephen Cohena partner at Kohn, Kohn & Colapinto and chairman of the board of directors of the National Whistleblower Center. Read the full article

Nasdaq, September 25, 2020

Nasdaq

Julius Baer ordered to pay 150 mln Sfr over vanished East German cash

Swiss private bank Julius Baer BAER.Scould seek to recoup 150 million Swiss francs ($162 million) from UBS UBSG.S after it was ordered on Friday to repay the German government over millions in East German cash that vanished after the fall of the Berlin Wall. Read the full article

Newsmax, September 22, 2020

American Expat Financial News Journal, September 19, 2020

‘Lucifer’s Banker’ Birkenfeld back Sept. 30, with ‘uncensored’ update of tell-all book

On the last page of his best-selling, 2016 saga of his journey from Geneva-based UBS banker to U.S. government whistle-blower, federal prisoner, and finally, recipient of a record-breaking US$104 million whistle-blower award from Uncle Sam, Brad Birkenfeld hinted that he might not be heading for a low-key early retirement in some glossy, upscale gated community anytime soon. Even though he could well afford it. Read the full article

Voice of America News, September 19, 2020

Lucifer’s Banker Uncensored

To say that Bradley Birkenfeld is an icon of the free world would be an understatement — he’s done much more — he’s become the true American hero. Read the full article

Sharyl Attkisson, September 15, 2020

SHARYL ATTKISSON

Lucifer’s Banker: Uncensored

Brad Birkenfeld is the most highly-punished and highly-paid whistleblower in American history. His new book Lucifer’s Banker Uncensored reveals some still-lingering secrets from his work blowing the whistle on rich and powerful Americans who illegally hid their wealth in the Swiss bank where he worked as a private banker. Read the full article

finews.com, September 7, 2020

Switzerland’s PDVSA Rinsing Problem

Years of graft at Venezuelan oil firm PDVSA represents one of the biggest financial pilferings in recent history. Swiss banks are in the midst, suspected of laundering the funds – but investigations appear to have fizzled. Read the full article

Swissinfo, August 24, 2020

Belgium investigates Credit Suisse over hidden bank accounts

Belgian prosecutors have launched an investigation into whether Swiss bank Credit Suisse helped some 2,650 Belgians hide money in Swiss accounts. Read the full article

ERR.ee, July 22, 2020

State developing bill to protect whistleblowers

The Ministry of Justice is preparing to develop a bill to protect whistleblowers. By the end of 2021, Estonia must transfer the EU’s Directive on the Protection of Whistleblowers into law. Read the full article

Reuters, July 15, 2020

UBS will no longer be able to contest client data sent to France tax authorities: Swiss court

UBS will no longer be informed or be able to contest customer data the Swiss tax authorities hand over to counterparties in France investigating alleged tax avoidance, a Swiss court said on Wednesday. Read the full article

Shadowproof, June 16, 2020

Northrop Grumman Accused Of Retaliating Against CIA Whistleblower

Northrop Grumman, the third largest military contractor in the world, was allegedly involved in falsely accusing CIA whistleblower John Kiriakou of “revenge porn.” The false accusation allegedly resulted in his arrest, improper charges, and a police raid that violated his privacy rights. Read the full article

American Expat Financial News Journal, May 5, 2020

Focus on whistleblowers in Washington, as SEC, CFTC announce latest (un-named) reward recipients

Whistleblowing, it seems, has become an important tool in the U.S. government’s compliance arsenal over the 13 years since an American UBS banker named Brad Birkenfeld famously came forward in 2007 to reveal how Swiss banks were enticing wealthy Americans to stash their assets in Swiss institutions, where the country’s strict bank secrecy laws meant that they weren’t expected to pay tax on it. Read the full article

Tax Notes, May 4, 2020

Birkenfeld Could Nab Bigger Slice of Collected Proceeds

UBS whistleblower Bradley Birkenfeld could be getting more money from the IRS now that the Tax Court has sent his case back to the agency to reconsider his award under the expanded definition of collected proceeds. Read the full article

Full Measure, May 3, 2020

Unfinished Business: The Whistleblower

Now we’re going to catch up with a man who may be one of the world’s most intriguing whistleblowers, he’s definitely one of the richest. He’s Brad Birkenfeld, the one-time Swiss banker who turned evidence against U.S. tax evaders only to find the U.S. Justice Department targeting him. Today, his Unfinished business. Watch the interview

Reuters, April 17, 2020

EY whistleblower awarded $11 million after suppression of gold audit

A British court awarded $11 million in damages and expenses on Friday to a former partner at global accounting firm Ernst & Young who exposed money laundering at a major gold refinery in the United Arab Emirates. Read the full article

ABA Journal, March 26, 2020

ABAJOURNAL

The ’emergency room of law’: Protections are critical for whistleblowers and their lawyers

The role of whistleblowers and attorneys who represent them has taken on crucial—perhaps existential—importance this year. With the outbreak of the coronavirus and the presidential impeachment trial, whistleblowers have aimed a 20,000-watt interrogation lamp at government agencies and officials at the highest levels. Read the full article

The New York Times, March 17, 2020

![]()

She Tracked Nazi-Looted Art. She Quit When No One Returned It.

A researcher stopped working for a German museum after she says she lost faith in its commitment to return works with tainted provenances. Read the full article

The Jerusalem Post, March 4, 2020

![]()

List found of 12,000 Nazis in Argentina with money in Swiss bank

An investigation by Argentine investigator Pedro Filipuzzi revealed a list of 12,000 Nazis in Argentina that apparently have money in accounts at the Zurich-based Credit Suisse investment bank, the Simon Wiesenthal Center said in a statement. Read the full article

ZeroHedge, January 22, 2020

Did Google Assassinate Wife Of Whistleblower Who Exposed The Search Engine?

A high-profile Google whistleblower who back in July testified before Congress that the search engine meddled in the 2016 presidential election on behalf of Hillary Clinton is now suggesting that the fatal car crash that killed his wife last month may not have been an accident. Read the full article

Harvard Business Review, January 14, 2020

Throw Out Your Assumptions About Whistleblowing

Whistleblowing stories are all over the news. Some observers have attributed this to a systemic change in society. There are more stories about whistleblowing, the argument goes, because there are more crimes to report. Read the full article

KYC360, January 3, 2020

Corruption whistleblower law enters into force in Ukraine

Ukraine’s new law amending anti-graft legislation and introducing “corruption whistleblowers” has entered into force. The law is set to protect and provide financial incentives to whistleblowers who report corruption-related offenses. Read the full article

The Daily Beast, January 1, 2020

How a Military Whistleblower Changed American History

In the 1960s, whistleblowers were treated like dirty snitches. Then Ron Ridenhour, a bit player in Vietnam’s horror show, stepped forward with tales of a massacre at My Lai. Read the full article

Government Accountability Project, December 11, 2019

TSA Whistleblower Charges Cover-Up of Ongoing Aviation Security Breakdown

Today, former Federal Air Marshal (FAM) Robert MacLean released his November 26 rebuttal to the Transportation Security Administration’s (TSA) incomplete report instigated by his whistleblower disclosures. The rebuttal, a 58-page white paper, details an ongoing aviation security breakdown. Addressed to the Office of Special Counsel (OSC), the paper also includes a legal analysis which argues that the TSA has failed to uphold Whistleblower Protection Act (WPA) standards and act on his evidence of an ongoing terrorist threat. Read the full article

Reuters, December 10, 2019

UBS must defend against U.S. lawsuit over ‘catastrophic’ mortgage losses

SA federal judge on Tuesday rejected UBS Group AG’s bid to dismiss a U.S. government lawsuit accusing Switzerland’s largest bank of causing “catastrophic” investor losses in residential mortgage-backed securities sold before the 2008 financial crisis. Read the full article

Reuters, December 4, 2019

Swiss court outlines rules for helping countries chase tax cheats

Switzerland’s highest court spelled out the steps foreign authorities must take if they want legal assistance in chasing tax cheats as it released the written verdict on why it made UBS Group in July share client data with France. Read the full article

Rolling Stone, October 6, 2019

![]()

The Ukrainegate ‘Whisteblower’ Isn’t a Real Whistleblower

Start with the initial headline, in the story the Washington Post “broke” on September 18th… The Ukrainegate ‘Whisteblower’ Isn’t a Real Whistleblower – Rolling Stone Read the full article

Forbes, October 5, 2019

Secret Banking Secrecy Became Extinct One Year Ago Today

Villains in thriller plots often take the form of a Swiss banker. A tidy and trustworthy figure who asks few questions he channels foreign funds into some centuries-old vault. Read the full article

finews.com, October 4, 2019

Swiss Banking’s Biggest Blow-Ups

Credit Suisse’s spy scandal isn’t the first time Swiss bankers have hit the headlines for behaving badly. finews.com looks back at the ten biggest fiascos in the Swiss industry’s recent history. Read the full article

Consortium News, September 30, 2019

What was this CIA Officer Thinking?

The news is dominated by “the whistleblower,” the CIA officer who reported to the CIA Inspector General (IG) that President Donald Trump may have committed a crime during a conversation with the president of Ukraine. I’ve been fascinated by the story for a couple of reasons. Read the full article

The American Report, September 27, 2019

THE REAL WHISTLEBLOWER STORY: DENNIS MONTGOMERY, THE HAMMER, THE HARD DRIVES, THE WIRETAPPING OF TRUMP, AND THE PROSECUTION OF GENERAL FLYNN

The assault on President Trump by a partisan CIA operative and whistleblower who was placed in the White House to spy on the President is unparalleled in American history. While obstructionists roll out their latest hoax, the real whistleblower story has not bee told. Read the full article

CNBC, August 15, 2019

GE falls the most in 11 years after Madoff whistleblower calls it a ‘bigger fraud than Enron’

General Electric shares saw their biggest drop in more than a decade Thursday after Madoff whistleblower Harry Markopolos targeted the conglomerate in a new report, accusing it of issuing fraudulent financial statements to hide the extent of its problems. Read the full article

The Walrus, August 14, 2019

THE WALRUS

The Whistle-blower Who Got It wrong

On August 28, 2012, three days before his eleven-month term as a researcher for the health ministry in Victoria was due to end, Roderick MacIsaac found himself being interrogated. A PhD student at the University of Victoria, MacIsaac had been reviewing the effectiveness of British Columbia’s new smoking-cessation program. Read the full article

Compliance Week, August 6, 2019

COMPLIANCE WEEK

Swiss bank ignores compliance officer; pays $10.7M for tax evasion

LLB Verwaltung (Switzerland), a Swiss-based private bank, has reached a $10.7 million settlement and entered into a non-prosecution agreement with the U.S. Department of Justice for committing tax evasion after recommendations made by its compliance officer went ignored. Read the full article

Reuters, July 26, 2019

Swiss UBS ruling could open new doors on client data

Switzerland’s highest court has ruled that historical data about 40,000 UBS clients must be handed to French tax authorities in a landmark case that could set a precedent for foreign governments seeking information from Swiss banks. Read the full article

Fast Company, July 8, 2019

![]()

I could afford to be a whistleblower—but not everyone can

From 2008 to 2010, Antoine Deltour was an employee at PricewaterhouseCoopers (PwC), based out of the professional services firm’s Luxembourg offices. During his time there, Deltour discovered PwC was helping large corporations sidestep large tax sums by granting deals that allowed them to pay less than 1% in taxes. Read the full article

New York Post, June 26, 2019

Siblings sentenced for elaborate Swiss bank inheritance scam

Four of investor Harry Seggerman’s six children had a choice when he died in 2001 with more than $12 million illegally stashed in Swiss bank accounts — declare their share and pay taxes or keep the scam going. Read the full article

HuffPost, June 11, 2019

![]()

Here’s What Actual Whistleblowers Want You To Know Before You Become One, Too

Former Boeing, TSA and Federal Reserve whistleblowers share advice on how to do it right. Read the full article

Financial News, June 10, 2019

fn

RBC whistleblower: ‘I knew the bank would spend any amount to crush me’

My efforts at making conversation with John Banerjee, the former trader who blew the whistle on RBC after the Canadian bank’s London operation wrongly fired him, are falling flat. Read the full article

BBC News, June 6, 2019

![]()

Australia ABC raids expose lack of whistleblower protection

Police raids this week on an Australian journalist’s home and the Australian Broadcasting Corporation have left some people asking whether the country is doing enough to protect those who try to expose wrongdoing, as the BBC’s Phil Mercer reports from Sydney. Read the full article

Sharyl Attkisson, May 30, 2019

SHARYL ATTKISSON

$50,000 Whistleblower Award Offered in Unlawful Government Surveillance Case

Many of you are familiar with the forensically-proven Government spying on me and my family. It’s one of multiple documented surveillance abuses by our Government. Read the full article

CCN, May 10, 2019

Limousine Liberal Kevin Costner Sued for Hiding $20 Million in Secret Bank Account

Actor Kevin Costner, a limousine liberal who pays lip service to helping the poor, is accused of tax evasion and holding at least $20 million in a secret offshore UBS bank account. Read the full article

Law & Crime, May 9, 2019

LAW & CRIME

‘World-Renowned’ Whistleblower Sues Kevin Costner, Estée Lauder Billionaire for Alleged Fraud

A “world-renowned whistleblower” and author is suing Academy Award-winning American actor and director Kevin Costner and Estée Lauder chairman emeritus Leonard Lauder for alleged fraud, negligent misrepresentation and “intentional interference with advantageous or business relationship.” Read the full article

The Wall Street Journal, May 9, 2019

![]()

Whistleblower Alleges Actor, Cosmetics-Empire Heir Evaded Taxes

A convicted banker who collected the largest-ever whistleblower payout for reporting tax cheats accused actor Kevin Costner and an heir to the Estée Lauder cosmetics empire of tax evasion. Read the full article

Sharyl Attkisson, May 6, 2019

SHARYL ATTKISSON

How Barr Could Change the Federal Culture of Corruption in 60 Days

I’m in my 30th year of covering national news and I’ve learned a hard truth about the federal government under numerous administrations. It’s a culture where truth-telling is frowned upon; coverup is rewarded and encouraged. Read the full article

The Wall Street Journal, April 26, 2019

![]()

The Profitable Prospects of Snitching for the IRS

The Internal Revenue Service awarded more than $312 million to tipsters last year, according to a little-noticed report released in February. This total far outstrips the previous record of $125 million awarded in 2012. The 2018 rewards, paid in the fiscal year ended Sept. 30, were for additional collected revenue of $1.4 billion, compared with $191 million in fiscal 2017.

And the agency has already paid $115 million to whistleblowers for 2019, according to lawyers Dean Zerbe, Jeffrey Neiman and Gregory Lynam. They expect more to come.

Some recent payouts have been huge.

Last year, one tipster was awarded about $100 million, nearly one-third of the total, for turning in a multinational corporation. The person, a client of Mr. Zerbe, wishes to remain anonymous—as nearly all whistleblowers do.

To date, the largest known IRS whistleblower payment of $104 million went to Bradley Birkenfeld, a former private banker for UBS AG who did go public. His 2012 award was for turning in the Swiss banking giant, which admitted it encouraged U.S. taxpayers to hide assets abroad. Read the full article

HEC Paris, April 16, 2019

![]()

The protection of whistleblowers: What does the law say in France and in the US

Should whistleblowers be compensated or prosecuted? In their latest research, professors from HEC Paris Nicole Stolowy and Luc Paugam, together with Lawyer Aude Londero, shed light on the different realities faced by whistleblowers depending on jurisdictions, in France and in the United-States, through numerous examples. Read the full article

Bloomberg, March 18, 2019

UBS’s French Tax Woes Could Worsen

UBS Group AG thought it had seen the worst of its French tax scandal when the lender was slapped with a record $5 billion penalty in Paris last month. A looming Swiss Supreme Court ruling could add to its woes. Read the full article

Reuters, March 15, 2019

Deja vu: UBS tax case dredges up Swiss bank nightmares

A Swiss court will decide within weeks whether UBS must hand over historical client data to French tax authorities, a ruling that could open the door to fresh financial claims against Switzerland’s banks. Read the full article

Euronews, March 15, 2019

![]()

UBS sets aside 450 million euros for French tax case

Switzerland’s biggest bank, UBS, on Friday reported a nearly $400 million boost to its litigation provisions after a French court slapped it with a 4.5 billion euro (£3.8 billion) penalty last month. Read the full article

Channel NewsAsia, March 15, 2019

Junior trader files harassment, discrimination lawsuit against UBS

A former junior trader who accused UBS of mishandling a complaint of rape and sexual assault by senior colleagues against her has filed a claim in the UK for damages against the Swiss lender, legal documents seen by Reuters show. Read the full article

Reuters, March 14, 2019

HK suspends UBS sponsor license, fines it and others $100 million for IPO failures

Hong Kong’s securities regulator banned UBS from leading initial public offerings (IPOs) in the city for a year, while fining it and rivals including Morgan Stanley a combined $100 million for due diligence failures on a series of IPOs. Read the full article

Swissinfo, March 6, 2019

Swiss Banks an Italian Target After Record UBS French Fine

Italian financial police are demanding Swiss lenders disclose the names of bankers working in Italy, setting up a potential clash with regulators after UBS Group AG was hit with a record fine by French authorities. Read the full article

Le Temps, March 2019

![]()

Dix Ans Sans Secret Bancaire

Le 13 mars 2009, lorsque Hans-Rudolf Merz annonce la fin du secret bancaire, les prévisions sont très pessimistes pour la place financière, qui perd un puissant avantage concurrentiel. Dix ans plus tard, le paysage bancaire suisse est profondément remodelé, sans s’être écroulé. Read the full article

BoingBoing, February 24, 2019

![]()

France fines UBS €3.7b for helping rich French residents launder more than €10b

Swiss banking giant UBS has been hit with the largest fine in French history: €3.7b, the result of a 7-year investigation of the bank’s role in helping the wealthiest French citizens hide €10b from tax authorities. The fine is more than ten times larger than the next-largest fine in French history, when HSBC paid €300m over its wrongdoing. The fine represents 92% of the bank’s 2018 profits. Read the full article

MarketWatch, February 20, 2019

UBS ordered to pay $5.1 billion fine for helping wealthy French clients evade tax authorities

A French court ordered Switzerland’s largest bank, UBS to pay 4.5 billion euros ($5.1 billion) in fines and damages for helping wealthy French clients evade tax authorities, sending a stern warning to tax dodgers and the banks that aid them. Read the full article

The Star Vancouver, February 7, 2019

![]()

In Vancouver, a haven for money laundering, some people use ‘bags of cash’ to pay their property taxes

A councillor’s chance encounter with a taxpayer in the parking lot of city hall toting “bags of cash” to pay his property taxes has sparked a renewed focus on whether B.C. cities are doing enough to fight money laundering. Read the full article

The Sydney Morning Herald, January 30, 2019

![]()

A reward for whistleblowers who expose tax evaders

When investigative journalist Bastian Obermayer received the millions of leaked files from Panamanian law firm Mossack Fonseca, he was not having a good day. As the German reporter told Fraud Magazine, the rest of his family were sick, and he had just changed his sons’ sheets when the email arrived. “It went from being a bad day to a very good one.” Read the full article

Reuters, January 21, 2019

Ex-Swiss banker convicted for selling secret tax data to Germany

A former UBS (UBSG.S) banker accused of selling information about wealthy German tax evaders to German authorities was convicted of economic espionage by a Swiss court on Monday. Read the full article

Politico, December 19, 2018

POLITICO

Whistleblowers could lose out in EU tax rule shakeup

As if avoiding taxes were not enough, tax dodgers might soon escape the very rules designed to hold them accountable. The Council of the EU’s legal service has advised EU countries to exclude tax avoidance and evasion leaks from the protections granted to whistleblowers, according to an internal document seen by POLITICO. Read the full article

BBC News, December 19, 2018

![]()

Barclays fined $15m for whistleblowing breach

The New York State Department of Financial Services (DFS) found Barclays had violated local banking law and its own procedures during the handling of the matter. Read the full article

Reuters, November 15, 2018

French court to rule on $6 billion UBS trial on February 20

A French court said on Thursday it would hand down a verdict in the money laundering trial of UBS (UBSG.S) on Feb. 20, at the end of weeks of hearings during which the Swiss bank faced allegations of helping wealthy French people evade taxes. Read the full article

Reuters, November 8, 2018

U.S. sues UBS, alleges crisis-era mortgage securities fraud

The U.S. government on Thursday filed a civil fraud lawsuit accusing UBS Group AG (UBSG.S), Switzerland’s largest bank, of defrauding investors in its sale of residential mortgage-backed securities leading up to the 2008-09 global financial crisis. Read the full article

Swissinfo, November 8, 2018

French prosecutors demand 3.7 billion euro fine for UBS

French prosecutors demanded on Thursday that UBS pay a fine of 3.7 billion euros (CHF 4.2 million) in the Paris trial of the largest Swiss bank. Read the full article

Forbes, November 2, 2018

How Important Are Whistleblowers In Detecting Crime And Fraud?

In October, it was revealed that a whistleblower helped to report the major money laundering scandal at Danske Bank. The case involved €200 billion in suspicious payments being made through Danske’s Estonian branch between 2007 and 2015. Read the full article

Government Executive, November 2, 2018

Government Executive

Grassley Wins Declassification of CIA Documents on Monitoring Whistleblowers

After a four-and-a-half year wait, one of the Senate’s key whistleblower advocates succeeded in arranging the declassification of documents he says show that the CIA inappropriately monitored congressional staff correspondence with whistleblowers. Read the full article

ekathimerini.com, October 24, 2018

Ex-minister jailed as money laundering probe deepens

Former Socialist defense minister Yiannos Papantoniou and his wife Stavroula Kourakou were taken to Attica’s high-security Korydallos Prison on Wednesday after judicial authorities ordered them to be remanded in custody over charges of money laundering linked to alleged bribes from a state defense contract. Read the full article

ZeroHedge, October 17, 2018

How The FBI Silences Whistleblowers

The problem is that we are the exception to the rule. Most whistleblowers either suffer in anonymity or are personally, professionally, socially and financially ruined for speaking truth to power. Read the full article

JudicialWatch, October 12, 2018

TSA Punishes Whistleblowers for Reporting Rampant Misconduct Among Managers

Persistent misconduct by managers at the Transportation Security Administration (TSA) often goes unpunished and whistleblowers who report it as well as airport safety risks are penalized by senior officials, a bipartisan congressional investigation has concluded. Read the full article

Channel NewsAsia, October 11, 2018

French court refuses UBS request to drop money laundering charge

A French court on Thursday (Oct 11) threw out a request by Swiss bank UBS to drop money laundering charges and limit trial proceedings to complicity in tax fraud, which carries lighter penalties. Read the full article

Reuters, October 8, 2018

UBS goes on trial in France over alleged tax fraud

Reuters, October 8, 2018

Swiss bank UBS on trial in France over alleged tax fraud

Swiss bank UBS Group AG, its French unit and six executives faced charges of aggravated tax fraud and money laundering on Monday, the first day of a trial into allegations they helped wealthy clients avoid taxes in France. Read the full article

Reuters, October 5, 2018

Era of bank secrecy ends as Swiss start sharing account data

The era of mystery-cloaked numbered Swiss bank accounts has officially come to a close as Switzerland, the world’s biggest center for managing offshore wealth, began automatically sharing client data with tax authorities in dozens of other countries. Read the full article

The Wall Street Journal, September 18, 2018

![]()

SEC Proposal to Limit Big Whistleblower Awards Draws Criticism

A proposal from the Securities and Exchange Commission to change rules governing its whistleblower program was condemned by commenters who said the agency is turning its back on the tipsters who expose financial crimes. Read the full article

The American Conservative, September 19, 2018

No Good Deed Goes Unpunished

Last Friday, The Wall Street Journal reported that while its amnesty program for tax cheats is coming to a close, the IRS will continue its decade-long investigation of income tax evasion by tens of thousands of American billionaires and millionaires holding secret offshore accounts in Switzerland or otherwise. The program’s success, WSJ noted, was partly owned to one UBS bank whistleblower, Bradley Birkenfeld, who exposed his bank’s industrial scale criminality and helped recoup some over $780 million in owed taxes from UBS for the government. Read the full article

The Wall Street Journal, September 14, 2018

![]()

The IRS Is Still Coming for You, Offshore Tax Cheats

On Sept. 28, the Internal Revenue Service will end its program allowing American tax cheats with secret offshore accounts to confess them and avoid prison. In a statement, the IRS said it’s closing the program because of declining demand. Read the full article

The New York Times, August 28, 2018

![]()

Swiss Bank Makes $60M Deal With US Over Hidden Accounts

Federal prosecutors say a Swiss bank has reached an agreement to pay more than $60 million to the U.S. and provide information to investigators about concealed accounts Americans used to avoid taxes. Read the full article

The Malta Independent, August, 18, 2018

![]()

PD asks European Union to establish whistle-blower protection laws

Partit Demokratiku has written to the President of the European Parliament Antonio Tajani, the Vice President of the Commission Frans Timmermans, the Commissioner for Justice, Consumers and Gender Equality Věra Jourová, the Commissioner for Migration and Home Affairs Dimitris Avramopoulous, the European Parliament and the EP Petitions Committee and the ALDE MEP Group recommending that the concept and status of Whistle Blower be defined by Union legislation. Read the full article

Swissinfo, August 14, 2018

Zurich bank settles tax evasion probe with US

The Zürcher Kantonalbank (ZKB) has agreed to pay the United States Department of Justice (DOJ) $98.5 million (CHF97.7 million) to resolve a long-running investigation into its role in tax evasion by wealthy Americans using undeclared Swiss bank accounts. Read the full article

Swissinfo, July 19, 2018

Swiss bank settles US tax evasion probe

The Zurich-based Neue Privat Bank (NPB) has paid $5 million (CHF5 million) fine to settle a criminal tax evasion investigation in the United States. NPB is one of a handful of so-called ‘category 1’ Swiss or Swiss-based bank branches that were still facing sanctions at the start of this year. Read the full article

Financial Planning, July 12, 2018

![]()

Federal watchdog says DoL likely blocked protections for Wells Fargo fraudulent accounts whistleblowers

There’s a “substantial likelihood” the Department of Labor colluded with large corporate defendants in failing to protect whistleblowers, including some who reported Wells Fargo’s widespread practice of opening fraudulent accounts, according to a new decision by the U.S. Office of Special Counsel. Read the full article

National Whistleblower Center, July 11, 2018

NWC

Proposal for EU Whistleblower Directive – Letter from Bradley Birkenfeld and Stephen M. Kohn, Esq.

Read the letter

Reuters, June 14, 2018

Greek Supreme Court blocks extradition of Malta whistleblower

Greece’s Supreme Court ruled on Thursday against the extradition of a whistleblower at the center of a Maltese corruption scandal, judiciary sources said. Read the full article

London Evening Standard, May 11, 2018

EveningStandard

Barclays’ Jes Staley fined £640,000 by watchdogs for whistleblower hunt

Barclays chief executive Jes Staley was on Friday fined more than £640,000 for attempting to uncover the identity of a whistleblower. Read the full article

Reuters, May 6, 2018

Saudi king orders whistleblower protections in anti-corruption push

Swiss prosecutors are seeking a court ruling that would make it easier to convict whistleblowers for breaking the country’s bank secrecy law wherever they are in the world, legal documents show. Read the full article

The Wall Street Journal, April 27, 2018

![]()

Whistleblowers Hope for an Ally at IRS

Tipsters have helped the Internal Revenue Service collect $3.6 billion since 2007. Whistleblower lawyers hope Charles Rettig, the potential next leader of the agency, will make it easier to bring in still more cash. Read the full article

Financial News, April 23, 2018

fn

Whistleblowers attack decision not to ban Barclays chief

Whistleblowers have railed against the decision by UK financial regulators to allow the chief executive of Barclays to keep his job at the banking giant despite repeatedly trying to uncover the identity of an internal whistleblower. Read the full article

The Guardian, April 17, 2018

EU moves to bring in whistleblower protection law

Employees who blow the whistle on corporate tax avoidance or cheating on product standards would be entitled to special legal status under a draft EU law. Read the full article

National Whistleblower Center, March 2018

NWC

Whistleblowers’ reward approved for criminal sanctions issued against international financial institution for assisting U.S. citizens in evading taxes

The law firms of Zerbe, Miller, Fingeret, Frank & Jadav, PC (ZMF); Kohn, Kohn & Colapinto (KKC) and Robert Amsel, Esq. are pleased to announce today a key victory for tax whistleblowers with the filing of a joint stipulation for dismissal of the government’s appeal in the cases of Whistleblower 21276-13W and 21277-13W v. CIR, Case Nos. 17-1119 and 1120 (D.C. Cir.). Read the full article

The Wall Street Journal, March 29, 2018

![]()

Whistleblowers Win in Fight With IRS

Two whistleblowers won a battle with the U.S. Internal Revenue Service over their share of $74 million they helped the agency to collect, marking a change that attorneys say could encourage more people to flag wrongdoing. Read the full article

The Irish Times, March 16, 2018

THE IRISH TIMES

Whistleblowing systems: Common myths and how to overcome them

Whistleblowing is seldom out of the news these days, with scandals in some of Ireland’s most well-known organisations. Whistleblowing is not just a news story, though: it is a serious matter for any senior manager in Ireland. Read the full article

Fraud Magazine, March/April 2018

A ticking time bomb?

Fraud Magazine recently spoke with veteran CFEs Ján Lalka in the Czech Republic, Jonathan T. Marks in the U.S., and Sean McAuley in Scotland about how fraud examiners can help organizations develop secure, workable whistleblowing programs. This article explains why they’re essential and, in some cases, a matter of life and death. Read the full article

Wisconsin Lawyer, March 2018

WISCONSINLAWYER

Inside the Whistleblower’s World

Whistleblowers play a vital role in calling attention to bad behavior and trying to prevent its recurrence. Here, learn their motivations and how best to represent them. Read the full article

The Guardian, March 20, 2018

Malta corruption whistleblower hands herself in to police

A whistleblower at the centre of a corruption scandal surrounding Malta’s prime minister, Joseph Muscat, has handed herself in to police in Athens. Read the full article

The Washington Post, March 16, 2018

![]()

I went to prison for disclosing the CIA’s torture. Gina Haspel helped cover it up.

I was inside the CIA’s Langley, Va., headquarters on Sept. 11, 2001. Like all Americans, I was traumatized, and I volunteered to go overseas to help bring al-Qaeda’s leaders to justice. I headed counterterrorism operations in Pakistan from January to May 2002. Read the full article

Daily Beast, February 11, 2018

U.S. Intelligence Shuts Down Damning Report on Whistleblower Retaliation

The nation’s top intelligence watchdog put the brakes on a report last year that uncovered whistleblower reprisal issues within America’s spy agencies, The Daily Beast has learned. The move concealed a finding that the agencies—including the CIA and the NSA—were failing to protect intelligence workers who report waste, fraud, abuse, or criminality up the chain of command. Read the full article

Forbes, February 9, 2018

Congress In Budget Rolls Out Red Carpet For Tax Whistleblowers

The recently passed budget bill contains extremely good news for tax whistleblowers—with Congress making it clear that the federal government welcomes and will reward whistleblowers who provide information about illegal offshore accounts, big time tax cheats as well as traditional tax evasion. Swiss bankers and Panama tax lawyers are weeping. Read the full article

The Washington Post, January 25, 2018

![]()

Ex-Justice Dept. lawyer offered to sell secret U.S. whistleblower lawsuits to targets of the complaints

Jeffrey Wertkin had a plot to bring in business and impress his new partners after joining one of Washington’s most influential law firms. Read the article

Chuck Grassley, December 22, 2017

Grassley Reform Credited with Recovering More Than $56 Billion Lost to Fraud

U.S. Senator Chuck Grassley’s False Claims Act reforms helped the federal government recover more than $3.7 billion from fraudsters in fiscal year 2017, according to a Justice Department announcement yesterday. That brings the total amount of taxpayer dollars recovered from fraud since Grassley’s reforms to more than $56.1 billion. Read more

Prison Legal News, November 2017

Prison Legal News

To know the real level of incompetence and corruption that exists at the Department of Justice (DoJ), Lucifer’s Banker is a must read for every judge, prosecutor, probation officer, guard, lawyer and inmate! See more

Whistleblowers Protection Blog, November 1, 2017

WHISTLEBLOWERS PROTECTION BLOG

Breaking the Banks: the Swiss Bank Fraud Whistleblower

As part of our #GivingTuesday campaign, we are sharing several whistleblower stories from this year’s National Whistleblower Day celebration. Whistleblower Bradley Birkenfeld is a poster child of how whistleblowers who try to do the right thing can be utterly destroyed or highly rewarded. Read the full article and watch the video

Reuters, October 31, 2017

Exclusive: Swiss Prosecutors Seek Widening of Secrecy Law to Bankers Abroad

Swiss prosecutors are seeking a court ruling that would make it easier to convict whistleblowers for breaking the country’s bank secrecy law wherever they are in the world, legal documents show. Read the full article

Project on Government Oversight, September 27, 2017

Senators Press FBI for Updates on Whistleblower Reforms

Last week, Senator Chuck Grassley (R-IA), chairman of the Senate Judiciary Committee, and Senator Patrick Leahy (D-VT) urged the Department of Justice (DOJ) to enhance Federal Bureau of Investigation (FBI) whistleblower protections in a letter to Attorney General Jeff Sessions. The letter questioned how much the DOJ has done to implement recommendations from its own April 2014 report about its regulations protecting FBI whistleblowers. Read the full article

The Wire, August 14, 2017

Switzerland’s Biggest Political Party Threatens to Derail India’s Plan to Get Black Money Data

The Swiss People’s Party has said that India and ten other countries are “too corrupt” and that it will get enough support in the country’s parliament to halt the Indo-Swiss tax information exchange process. Read the full article

Swissinfo, July 27, 2017

Crowdfunding to reward whistleblowers

Would you blow the whistle on corrupt or unethical practices if you knew you would receive a cash reward? A new Swiss crowdfunding platform thinks that’s a good idea. And so do two notable Swiss whistleblowers, Bradley Birkenfeld and Rudolf Elmer, who both told swissinfo.ch that they support the project and its goals. Read the full article

CEO.CA, June 28, 2017

![]()

UBS Whistleblower Reveals the Secrets of Offshore Banking and Offers Expert Consultation to Help UBS and Swiss Bank Clients Get Their Rightful Compensation

For decades, the now-defunct façade of Swiss banking secrecy has cheated worldwide clients who deposited money in Switzerland, alleges UBS Whistleblower and former banker, Bradley Birkenfeld. In his explosive book, Lucifer’s Banker – The Untold Story of How I Destroyed Swiss Bank Secrecy, Birkenfeld details how UBS, one of the world’s largest banks, helped the ultra-wealthy commit tax fraud. Now, a team of senior ex-UBS bankers and international lawyers are lending their expertise to help former Swiss bank clients get their rightful compensation from “kickbacks” taken. Read the full article

Project on Government Oversight, June 13, 2017

Financial Sector Oversight Will Be Harmed by New Legislation

Legislation is moving through Congress that would put the Securities and Exchange Commission’s (SEC) invaluable whistleblower program in jeopardy by jettisoning important reforms created by the Dodd-Frank Wall Street Reform and Consumer Protection Act. Read the full article

PR Newswire, April 4, 2017

FinanzBuch Verlag: UBS Whistleblower Story Goes Global

After a successful release in the United States, UBS Whistleblower Bradley Birkenfeld’s memoirs “LUCIFER’S BANKER” is being highly sought after by book publishers around the world. Germany’s FinanzBuch Verlag will release the German version “DES TEUFEL’S BANKER” on April 10, 2017 in Germany, Austria, Liechtenstein and Switzerland. “We are very proud to be the first to launch the German version of Lucifer’s Banker in Europe,” stated Christian Jund (Chairman of FBV). Several international publishing deals are either signed or in development, including: France, Greece, Italy, Japan, Poland, Romania, Russia, Spain and Thailand. Read the full article

The Independent, March 26, 2017

![]()

Anyone appointed by elected officials should publicly disclose worldwide assets – UBS whistleblower

Along with Ministers, all individuals appointed by a country’s elected officials such as those in positions of trust should, upon being appointed, publicly disclose all their worldwide assets, according to UBS whistleblower Bradley Birkenfeld. Read the full article

Observer, January 26, 2017

The Obama Foundation Launches With Lobbyists and Wall Street at the Wheel

Immediately following his presidency, Barack Obama has begun marketing the Obama Foundation, which appears to use the same oligarchic formula that Bill and Hillary Clinton implemented in the Clinton Foundation in order to peddle their own influence and grow their personal wealth under the pretense of philanthropy. The Obama Foundation’s Board of Directors closely resembles the make-up of the Clinton Foundation’s board in that it relies on corporate lobbyists and financial industry insiders over philanthropy experts. Read the full article

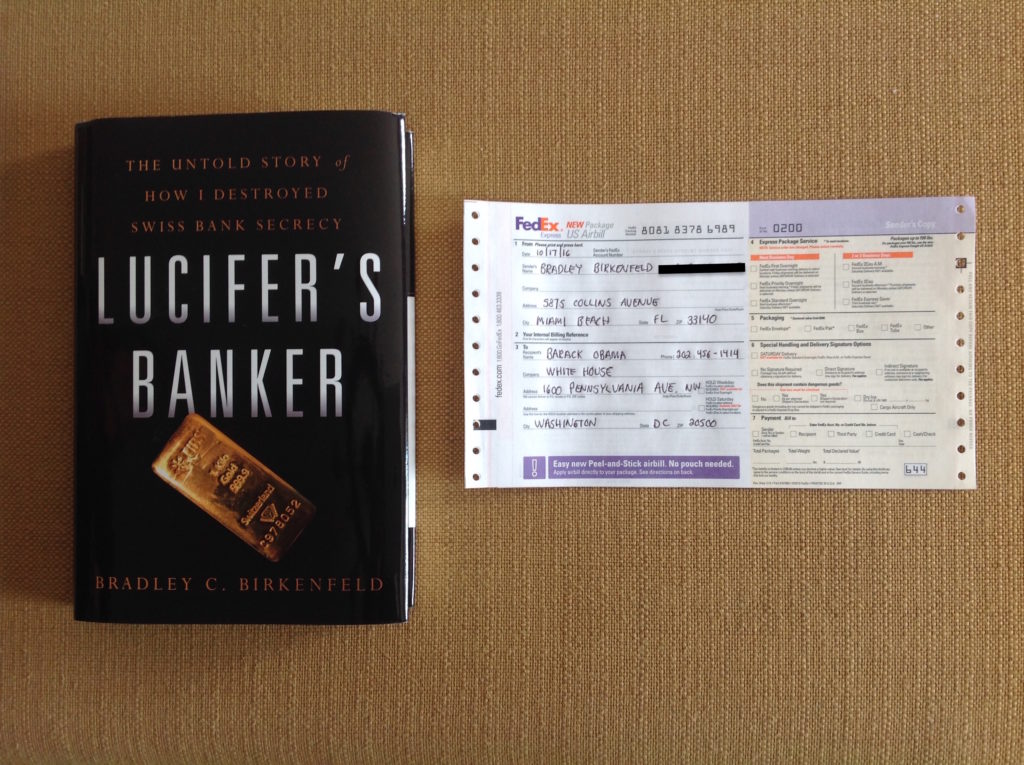

Read the October 1, 2016 letter Bradley Birkenfeld sent to President Obama

The Guardian, January 1, 2017

![]()

Jean-Claude Juncker blocked EU curbs on tax avoidance, cables show

The president of the European commission, Jean-Claude Juncker, spent years in his previous role as Luxembourg’s prime minister secretly blocking EU efforts to tackle tax avoidance by multinational corporations, leaked documents reveal. Read full article

Tax Justice Network, December 1, 2016

![]()

UN criticises Switzerland and pressure mounts over human rights impacts of tax havens

We’ve reported before on this blog on the groundbreaking situation whereby Switzerland—ranked number one in the Tax Justice Network’s Financial Secrecy Index – faced tough questions from a U.N. human rights body in Geneva over the toll that its tax and financial secrecy policies take on women’s rights across the globe. Read the full article

Observer, November 22, 2016

Snowden Fires Back at Obama’s War on Whistleblowers

“All they have to do is write a check,” said former banker Brad Birkenfeld, author of Lucifer’s Banker, in a phone interview with the Observer. In 2012, Birkenfeld was released from a 31-month prison sentence after approaching the Department of Justice with information that Swiss bank UBS was building their business by helping thousands of wealthy Americans evade taxes with secret Swiss accounts. Read the full article

International Investment, November 15, 2016

Swiss bank secrecy-destroyer Birkenfeld: the job isn’t finished yet

In a rare public appearance in London on Monday, ex-UBS banker and world-famous whistle-blower Brad Birkenfeld told an audience of financial services executives about his experiences – including his efforts to tell the world about how Swiss banks were intentionally enabling US clients to avoid paying billions of dollars in US taxes; his 31-month prison sentence; and his US$104m thank-you from the IRS – and urged them to come forward themselves, if they were in a position to. Read the full article

International Consortium of Investigative Journalists, November 6, 2017

Leaked Documents Expose Secret Tale of Apple’s Offshore Island Hop

Elite tax advisers help Apple Inc. and other corporate giants skirt impacts of crackdown on ‘Double Irish’ maneuvers. Read the full article

ValueWalk, November 6, 2016

Lucifer’s Banker: The Untold Story of How I Destroyed Swiss Bank Secrecy

Bradley C. Birkenfeld was, in the words of CNBC, “the most significant financial whistle-blower of all time.” In Lucifer’s Banker: The Untold Story of How I Destroyed Swiss Bank Secrecy (Greenleaf Book Group Press, 2016) Birkenfeld, with the very able assistance of Steven Hartov, tells a harrowing tale, beginning with “All roads that lead to federal prisons are long.” Read the full article

Progressive Commentary Hour with Gary Null, November 1, 2016

A look at the 2009 UBS scandal, banking fraud, corruption and the funding of illegal activities and why such nefarious activities among global elite matter. Listen to the podcast

Business Game Changers with Sarah Westall, October 31, 2016

Whistleblower’s New Book Details Incredible Corruption by Hillary, Obama, and the U.S. Justice Department

This episode of Business Game Changers features an explosive interview with Bradley Birkenfeld, an American banker who blew the whistle on the corrupt offshore banking practices of the world’s largest bank, UBS. His disclosures led to massive fraud and tax evasion investigations of U.S. taxpayers, UBS, and other banking giants. Read the full article/listen to the podcast

Corporate Crime Reporter, October 31, 2016

Bradley Birkenfeld Wants Senate Hearing on Failure of Justice Department to Crack Down On Corporate Crime

Bradley Birkenfeld blew the whistle on his employer — the Swiss bank UBS and on the largest tax fraud in U.S. history. The upside result was that Birkenfeld secured the largest whistleblower award in U.S. history — $104 million. Read the full article

BreakingViews, Reuters, October 28, 2016

Blind Justice

The story of a UBS banker-turned-whistleblower sounds a cautionary note. Bradley Birkenfeld helped expose tax evasion at the Swiss lender, landing it with a big fine and cracking open the country’s bank secrecy rules. Though he collected a $104 million reward, he also ended up in jail. Read the full article

Justice Integrity Project, October 24, 2016

Courageous Memoir Denounces Bank, Justice Dept. Corruption

Famed bank whistleblower Bradley Birkenfeld launched his tell-all memoir Lucifer’s Banker last week at the National Press Club with a harsh indictment of the nearby headquarters of the U.S. Justice Department. Read the full article

Down with Tyranny, October 21, 2016

A Devil’s Advocate Rings in a Bad Night for Bankers

Skip Kaltenheuser writes: “After reading Birkenfeld’s book, and speaking with an FBI whistleblower at the launch party, I have to laugh at my quaint notion that government waits eager to ride to the rescue of the little guy, to champion even those dwelling far beneath potential headlines with political mileage….if Birkenfeld’s book inspires the aggrieved to find voice, to tell their own stories of injustice at the ground level, they may awake others to the peril slack government places us in. That alone would make the book worth its ink.” Read the full article

Book Launch, October 18, 2016

Bradley Birkenfeld announces the release of his book Lucifer’s Banker

at the National Press Club, Washington, DC

Watch the C-SPAN video from the book launch

Lucifer’s Banker comes to Washington!

The Big Picture, October 18, 2016

Lucifer’s Banker On Bringing Down U.B.S.

Corporate Crime Reporter, October 18, 2016

Bradley Birkenfeld on Corporate Crime in the USA

Corporate Crime Reporter attended the Lucifer’s Banker launch, noting that the book “…clearly exposes our system of no fault corporate crime….” and that “Birkenfeld exposes the perverse outcomes of that system at almost every turn.” Read the full article

The White House, October 17, 2016

Bradley Birkenfeld sent the President a copy of Lucifer’s Banker along with a letter that begins: Dear President Obama, I am Bradley C. Birkenfeld, the most significant financial whistleblower in history. Read the full letter

The Hill Times, October 17, 2016

Whistleblower who helped U.S. recover 5-billion in taxes wants to help Canada too.

Bradley Birkenfeld told The Hill Times that he’d be happy to provide valuable information with documents that could help Canadian authorities recover unpaid federal taxes in offshore accounts. It’s estimated that Revenue Canada is losing about $8-billion in lost taxes from offshore bank accounts each year. Read the full article

Coast to Coast, October 17, 2016

Banking Whistleblower

In the first half, retired financial industry professional Bradley Birkenfeld discussed how he blew the whistle on decades of dirty dealings by Swiss banks — and brought down a corrupt system that enabled powerful, moneyed people to hide assets and evade taxes. Listen to the interview

Thom Hartmann, October 17, 2016

How “Lucifer’s Banker” Brought Down The Swiss Bankers (w/Guest: Brad Birkenfeld)

MEL Magazine, October 16, 2016

I Won $104 Million for Blowing the Whistle on My Company—But Somehow I Was the Only One Who Went to Jail

The story of Bradley A. Birkenfeld, the first in our series of Unusual Millionaires (as told to Ben Feldheim). Read the full article

International Business Times, August 25, 2016

UBS whistleblower exposes ‘political prostitution’ all the way up to President Obama

Read the full article

Democracy Now! August 25, 2009

“Who is Obama Playing Ball With?” By Amy Goodman

It looked like it was business as usual for President Barack Obama on the first day of his Martha’s Vineyard vacation, as he spent five hours golfing with Robert Wolf, president of UBS Investment Bank and chairman and CEO of UBS Group Americas. Read the full article

The New York Times, May 11, 2004

![]()

UBS Fined $100 Million Over Trading of Dollars

The Federal Reserve fined Switzerland’s largest bank, UBS, $100 million on Monday, accusing it of violating United States trade sanctions by sending dollars to Cuba, Iran, Libya and Yugoslavia. Read the full article